Small Business Accountants Things To Know Before You Get This

Wiki Article

Small Business Accountants for Beginners

Table of ContentsSee This Report about Small Business AccountantsThe Best Strategy To Use For Small Business AccountantsGet This Report on Small Business AccountantsRumored Buzz on Small Business Accountants

An additional significant advantage of hiring a bookkeeper is that they are skilled in assessing where a business stands on an economic level. This assists companies make educated monetary decisions. Considering that bookkeeping can be extremely laborious, hiring a bookkeeper maximizes more time for you as well as your workers to invest in your main obligations (small business accountants).

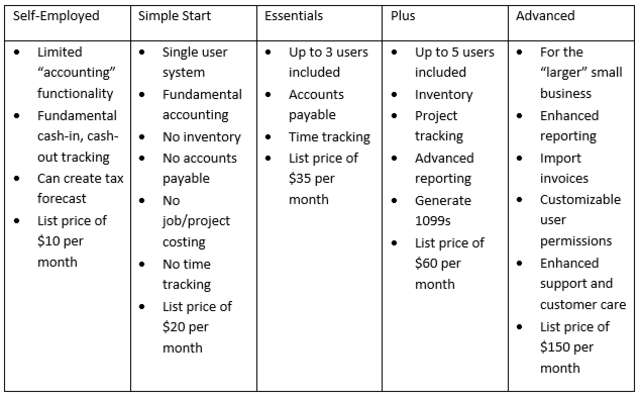

Considering that the software program an accountant uses is crucial to their capability to finish their tasks in a prompt and also reliable fashion, you must constantly ask your prospects which sorts of software they are experienced in. If you already have software application that you want them to utilize, you need to ask if they have experience using that program or comparable ones.

Whether you employ an accounting professional, an accountant, or both, it's crucial that the individuals are certified by asking for customer references, examining for accreditations or running screening examinations. Bookkeepers "may not constantly be licensed and the onus is extra on experience," noted Angie Mohr in an Intuit blog article. small business accountants.

Not known Details About Small Business Accountants

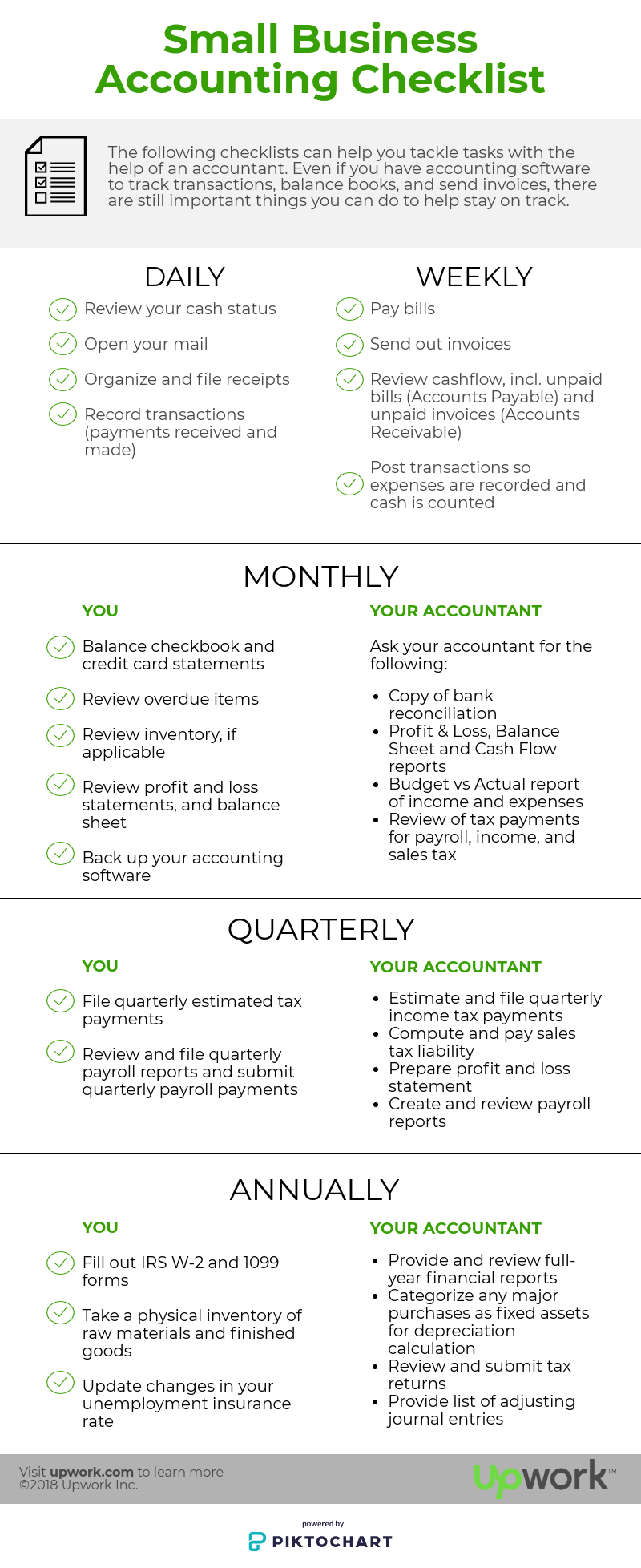

They can assist your firm communicate with the federal government in other means. Full and also file the needed legal and conformity papers for your business, Keep your company approximately date with the most current tax obligation legislations, Prepare yearly statements of accounts, Keep your company's condition upgraded in the federal government's firm register, Maintain records of directors and also various other management workers, Organise and record share/stock allowance, such as when the service is formed when a business partner leaves or a new companion joins, Manage your payroll as well as guaranteeing that all employees' tax obligation codes and payments are recorded appropriately.That is if those clients had not waited so long to ask for aid. The bottom line is that there are numerous crucial times in the program of your company when you do not want to wing it without an accounting professional. Creating Your Business, The development of your business is among those crucial times.

Compliance and Tax Obligation Issues, Even if your company strategy is written, you have all the called for authorizations as well as licenses, and your bookkeeping software application is brand-new and glossy as well as prepared to go you're not fairly prepared to move forward without an accounting professional. There are still lots of compliance stumbling blocks to get rid of.

Sales tax conformity in the United States is promptly coming to be a problem. If you'll be shipping your products out of stateor in some situations, also within the same stateyou'll intend to make sure you follow all the applicable tax obligation legislations. There are applications to assist with this on a recurring basis, however you'll want an accounting professional to help you get whatever established.

Small Business Accountants Fundamentals Explained

Wage and work conformity problems can sink even one of the most profitable businesses. Similar to sales taxes, there are apps as well as programs that can aid you with conformity on a continuous basis, but you'll want an accountant to look over your shoulder a minimum of quarterly. Other reporting needs. These can be requirements for lenders or licensing firms.Getting in deals: Transactions got in click to investigate might consist of sales made, expense of materials acquired, worker payment and advantages, hrs worked, lease, IT, insurance policy, workplace materials, and other expenses paid. Coverage actual outcomes or the projections of future results: Records may cover the standing of prospective clients, sales made, sales made where customers have actually not yet paid, expense contrasts with the budget plan and exact same duration last year, all kind of tax obligation reports, monetary statements, and information required to please bank lending agreements.

The 3 options are to do it on your own, designate somebody on your group to do it or to outsource to an accountant or accountant. Typically with a startup, you are the only staff member, and there are restricted funds offered, so originally, the creator frequently does all the accounting. As quickly as you have enough discretionary funds, you can take into consideration outsourcing the task.

You can likewise position ads in your regional paper, on Craigslist or various other such discussion forums, or go to the American Institute of Expert Bookkeepers. Do not Outsource It and Forget It (small business accountants). Think about contracting out to an accounting professional and/or bookkeeper if you do not have the time, skills, or inclination to do this job.

Getting The Small Business Accountants To Work

Possibly half the accountant's time is spent working with the 'documents' the firm is continually generating concerning its earnings and also expenses, and maybe the other fifty percent of his time is invested in consultation with you on accounting technique. This will include his suggestions, based upon the financials, on just how to best invest your firm's money on resources needed to maintain business rewarding.

It may cost you a few hundred dollars, however that's a tiny investment because of the effect an accounting professional can carry your small business. And also if you desire to be amongst the 89% of local business owner that see a bump from official site collaborating with a financial pro, then begin your search for an accounting professional currently.

Report this wiki page